Between 2005 and 2010, the population in the UAE grew by a large margin, almost doubling in a span of five years. This is mainly due to the increasing number of expats moving to the region to benefit from the attractive benefits of this popular investment and lifestyle destination.

As of 2025, expats make up over 88% of the UAE’s population. That equals approximately 9.2 million foreign residents. Among the seven emirates in the UAE, Dubai has the highest population of expats. It is also widely recognized as one of the top destinations for highly qualified professionals, primarily due to its high quality of life and many other financial benefits, including tax advantages.

For most expats in Dubai, the goal is often to attain financial success and independence. While Dubai offers an attractive lifestyle for foreigners, navigating its unique regulatory and legal framework can be challenging. This is where a qualified financial advisor in Dubai can make a meaningful difference, offering professional, reliable, and trustworthy guidance, provided that you make the right choice.

This article offers a comprehensive guide to financial advisors in Dubai, covering their role, services, importance, and how to choose the right individual or firm.

Also referred to as a financial consultant, a financial advisor is a licensed professional who provides expert guidance to individuals, families, and businesses, as well as expats living in Dubai. Their goal is to help clients manage their finances and build wealth while navigating and complying with the UAE’s unique legal system.

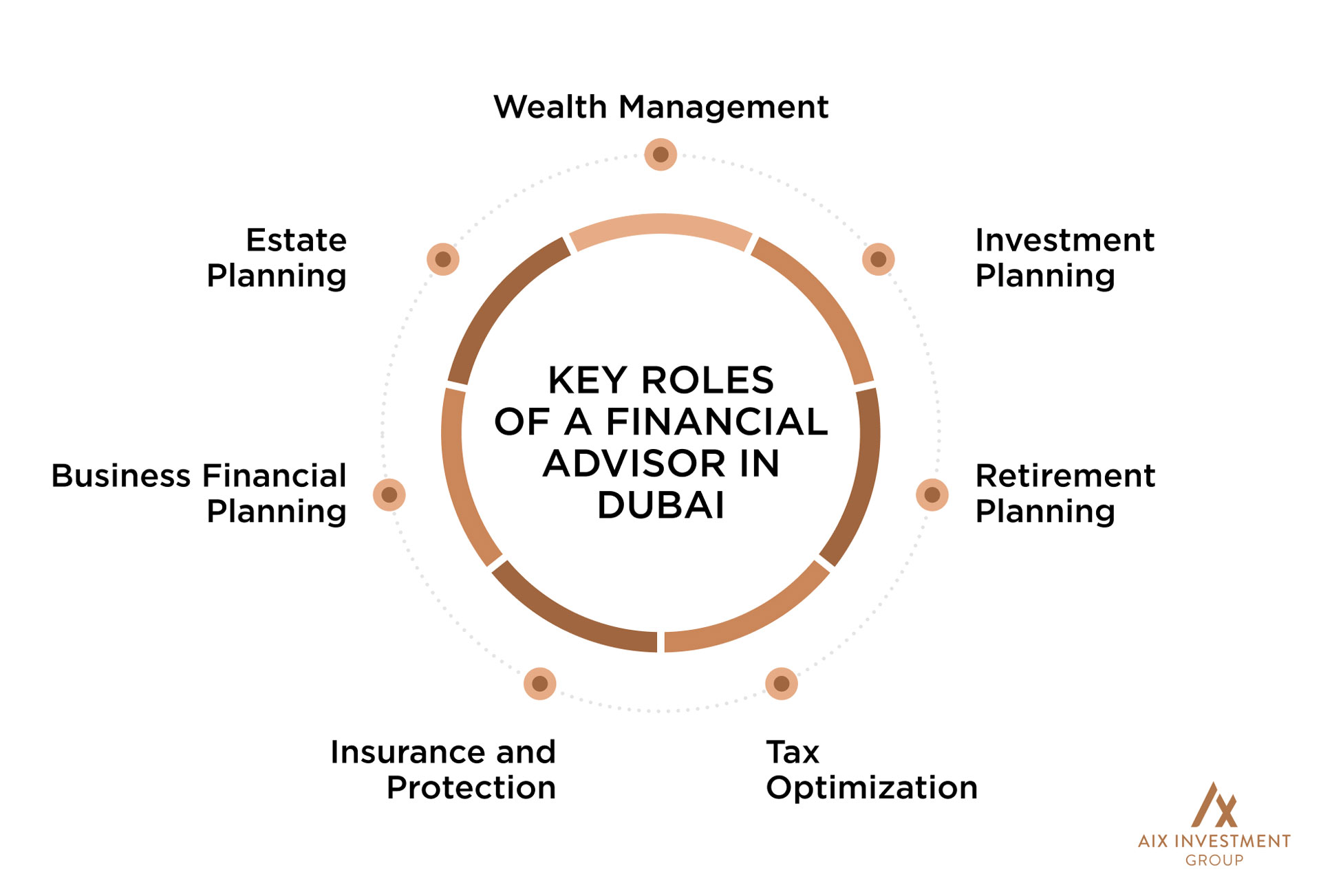

The services offered by financial advisors in Dubai are a direct reflection of their role and responsibilities. Below is a simple breakdown of these roles and the services provided under each.

One of a financial advisor’s key responsibilities is to help clients develop a long-term strategy to grow and preserve their wealth. This involves assessing income, lifestyle goals, and risk tolerance to create a personalized financial plan tailored to each individual’s unique needs and goals. Strategies may include real estate investments, savings plans, offshore accounts, and more. Financial advisors who specialize in wealth management also assist with the smooth transfer of assets to the next generation or legally eligible beneficiaries, ensuring the client’s legacy is preserved.

Financial advisors help expats make informed investments in both local and international markets. They evaluate your financial goals and risk tolerance to recommend suitable investment products, such as mutual funds, fixed-income securities, or real estate options. They guide you through Dubai’s dynamic investment landscape, minimizing unnecessary risk while aligning strategies with your personal financial objectives.

Retirement planning is another essential service offered by financial advisors. Since Dubai does not provide a state pension for expats, retirement planning is non-negotiable. Financial consultants help estimate future expenses, set realistic goals, and choose the most suitable and feasible options for retirement. This can include offshore pensions, long-term savings plans, or annuities to build a reliable retirement fund.

Dubai and the UAE, in general, do not impose income tax on individuals. However, financial advisors can help in structuring their income and assets to reduce global tax liabilities. This may involve offshore structures, tax-efficient investments, and strategic use of UAE residency status.

A financial advisor in Dubai can also help recommend ideal insurance policies to protect your income and family in unforeseen events. The insurance package can help cover future expenses in the case of death, critical illness, disability, and even international health plans.

In the UAE, inheritance laws strictly adhere to Sharia principles, making estate planning essential for expats. Financial advisors in Dubai can assist with:

Estate planning services help in ensuring all assets are distributed according to your personal goals while adhering to local laws.

For expat business owners, a financial advisor in Dubai provides tailored guidance for managing company finances. This includes cash flow management, selecting the appropriate legal structures, safeguarding business assets, and planning for business continuity and long-term success.

Financial consultants will analyze the health and performance of your business, evaluate market conditions, conduct a competitive assessment, and recommend sustainable solutions to help an organization effectively reach its goals.

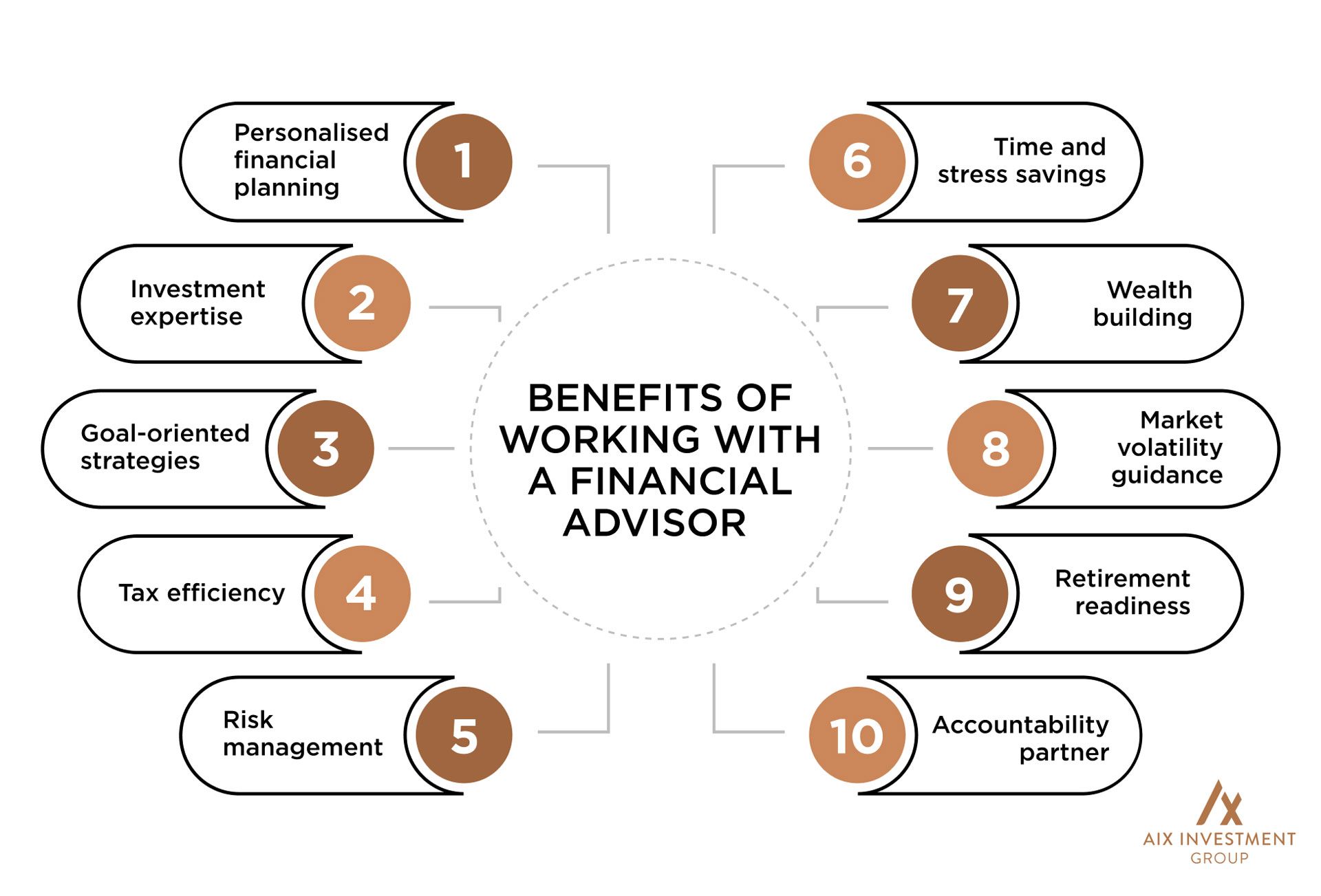

A professional financial consultant in Dubai can help you define short-term and long-term financial goals, whether personal or business-related. They assess what financial success means to you, evaluate its feasibility, and outline the steps needed to achieve it.

Financial consultants are licensed, qualified professionals trained in all aspects of financial planning. They offer unbiased advice, understand risk profiles, and can anticipate how market forces may impact your financial decisions.

With their knowledge and expertise, financial advisors can create a customized financial plan tailored to your objectives. They will also guide you in understanding how you can maximize local and global market dynamics.

A financial advisor in Dubai offers expats the following advantages in terms of local knowledge:

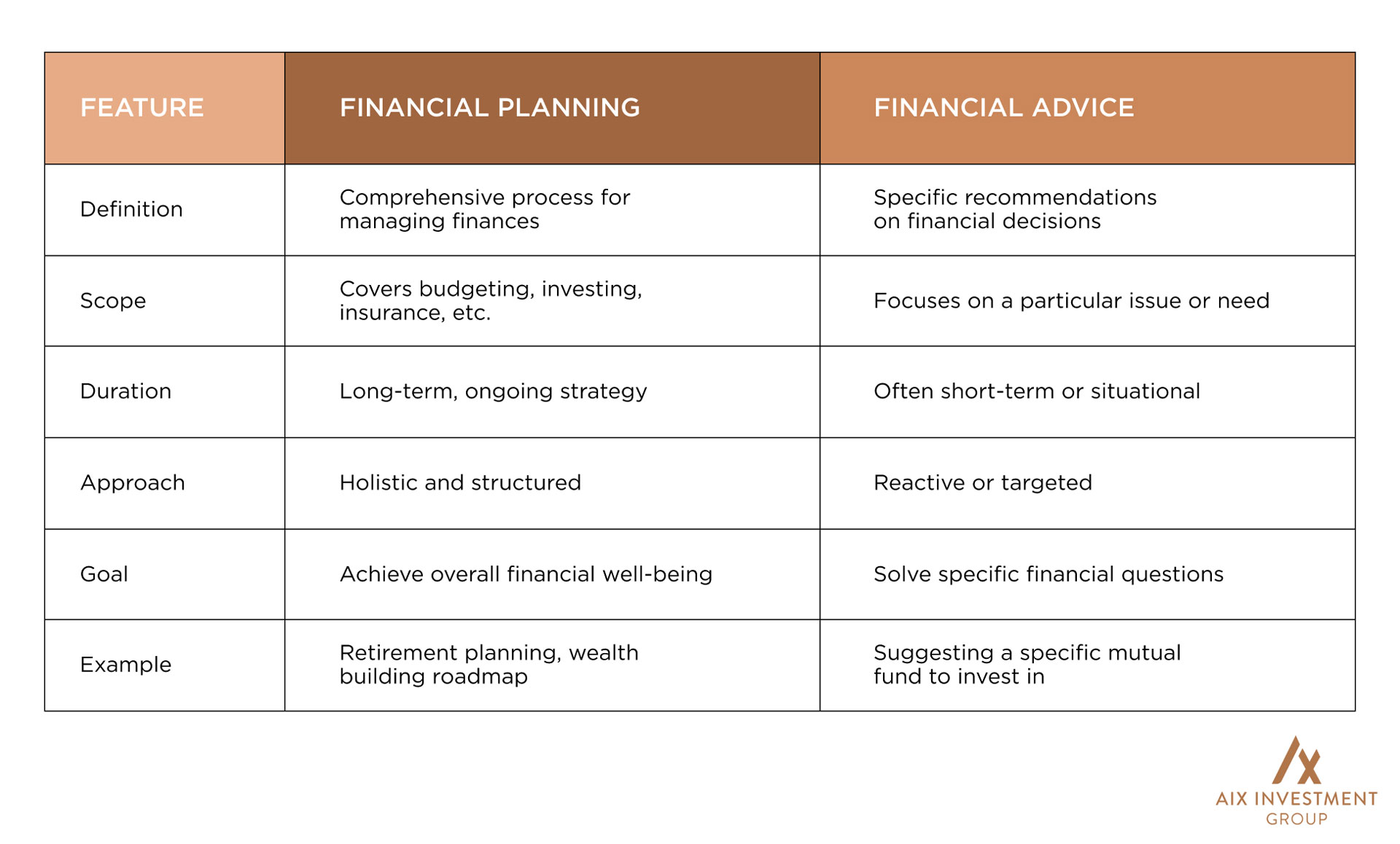

While financial planning and financial advice are often used interchangeably, they have distinct meanings.

Financial planning is a comprehensive process that involves developing a structured plan to manage your finances and build wealth. Its primary goal is to create a clear, realistic, and achievable roadmap tailored to your specific financial objectives.

Some of the key roles of financial planning include, but are not limited to:

Financial advice, on the other hand, is focused on providing specific guidance to help you make informed decisions about managing your money. Financial advisors typically specialize in recommending financial products, including investment opportunities, savings plans, and insurance policies. Their advice is based on proven strategies, professional experience, and a deep understanding of market dynamics.

Common services that require financial advice:

The right financial advisors can help expats navigate the path to financial independence and achieve their goals with greater clarity and confidence. You must be able to trust them to provide well-informed and reliable guidance. You need a financial advisor who can manage market uncertainties while aligning with your financial objectives.

Here are some key factors to consider when choosing a financial advisor in Dubai:

A financial advisor should be licensed to offer their services. Always verify their qualifications and background to ensure they are approved and certified by the relevant regulatory authorities in Dubai.

Experience is another non-negotiable factor when looking for a financial consultant in Dubai. Only industry expertise and hands-on experience can ensure the advice you receive is practical, tested, and aligned with your goals.

Experience and certifications are significant indicators of a financial advisor’s exposure to different market dynamics, risk criteria, and other legal factors that can impact the financial strategies of expats in Dubai.

Since financial advice often leads to measurable outcomes, a good reputation typically reflects consistent performance, client satisfaction, and a proven ability to deliver tangible financial growth over time.

Always ensure the financial advisor you choose in Dubai has a strong reputation. Check for reviews, testimonials, and seek recommendations from trusted friends and family. Doing your due diligence can help ensure you’re working with someone who is both credible and capable of guiding you toward your financial goals.

Financial advisors in Dubai generally charge in one of two ways: (1) fees or (2) commissions. Fees involve a flat charge for the services provided, while commissions are based on a percentage of the assets or wealth they manage.

Regardless of the fee structure, a reputable financial consultant will always be transparent about costs, ensuring there are no hidden charges.

Not everyone has the same goals when they seek financial advice. A good financial advisor will take the time to fully understand your goals, desired lifestyle, and expectations before offering recommendations. Moreover, financial advisors will carefully evaluate all viable strategies and guide you in identifying the best option.

In a fast-paced and financially diverse city like Dubai, expert guidance isn’t just helpful, it’s essential. From navigating investment opportunities and tax structures to planning for retirement or protecting your family’s future, the role of a trusted financial advisor cannot be overstated.

AIX stands out in this space by combining global expertise with local insight, offering tailored strategies that align with your personal and financial goals. Whether you’re an expat building your future or a business owner looking to optimize your finances, AIX is committed to helping you achieve long-term financial security and independence.

Get in touch with AIX today and take the first step toward building a confident and well-managed financial future.

Fees can vary depending on the advisor’s experience, the services offered, and the complexity of your financial situation. Financial advisors in Dubai typically follow this payment structure:

Always ensure that the fee structure is transparent and aligns with the value of the services you receive.

Yes, especially for expats in Dubai. The right financial advisor can offer significant value for your money, providing peace of mind and a clear path toward your financial goals. They support strategic, informed decision-making and help you avoid costly mistakes that can arise from a lack of local knowledge. Given the complexities of legal systems, tax structures, and the wealth management landscape in the UAE, expert and up-to-date guidance is essential, and that’s exactly what a qualified financial advisor provides.

You don’t need to be a millionaire to benefit from a financial advisor. A good advisor helps you grow and secure your wealth based on your individual needs, budget, and risk tolerance. For example, if you have $250,000 or more in investable assets and feel uncertain about planning, tax optimization, or your overall financial strategy, it’s an ideal time to seek professional advice.

A lack of clear financial goals, increasing tax complexity, emotional decision-making, and major life changes are all strong indicators that you need to seek help from a financial advisor.

Some of the common mistakes people make when hiring a financial advisor include:

Overview