Mutual funds have long been a preferred investment option, especially in global hubs like Dubai. They appeal to investors seeking to grow wealth with minimal hassle. By pooling resources and spreading risk across multiple assets, mutual funds provide a smart entry point into the investment market for new and seasoned investors.

In this blog, we’ll cover everything you need to know about mutual funds in Dubai: what they are, how they work, their benefits, the different types available, and how to invest in them the right way.

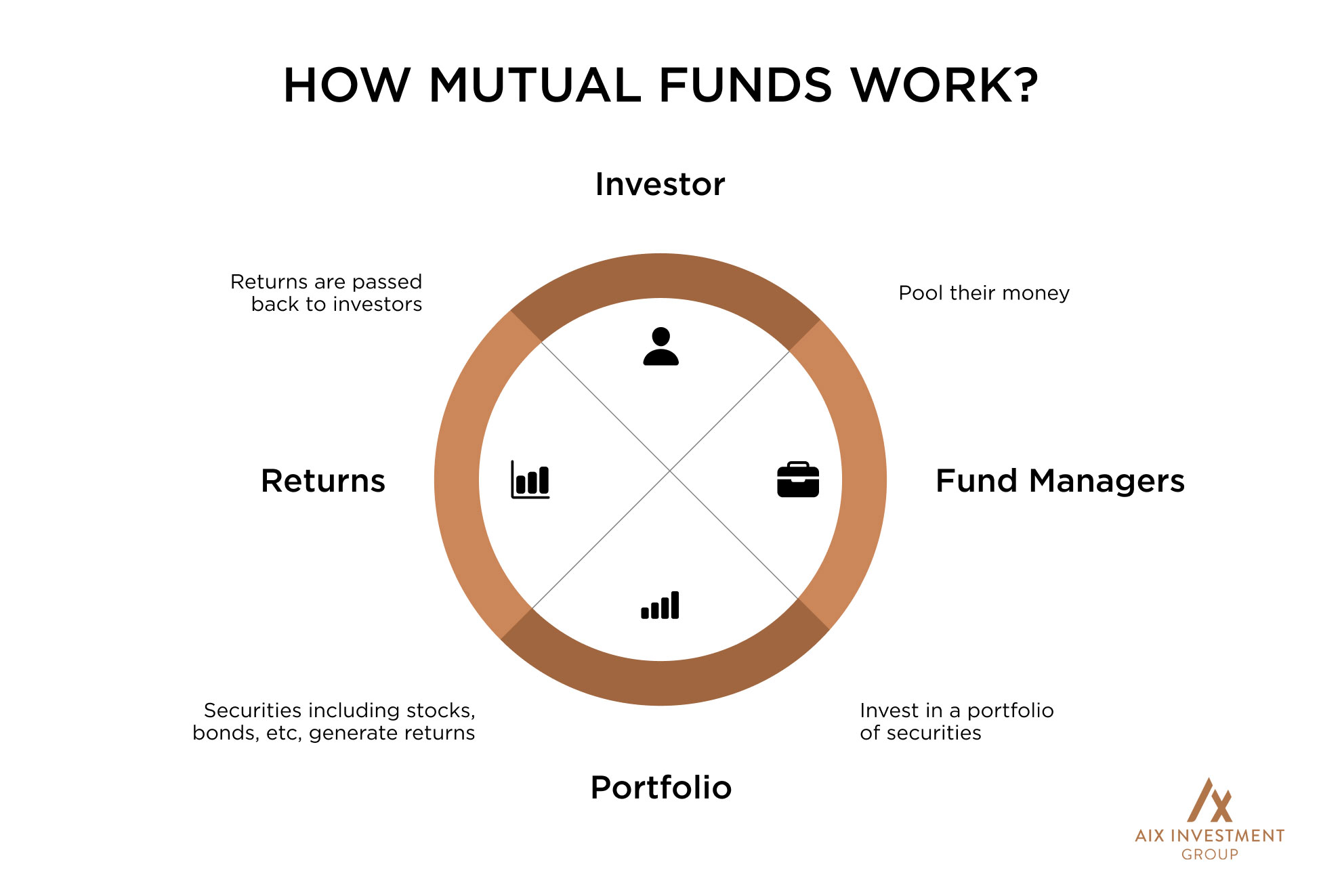

A mutual fund is a financial instrument or a pooled investment vehicle that collects money from multiple investors. The capital raised will be invested in a diversified portfolio of assets such as stocks, bonds, money market instruments, or other securities.

In other words, mutual funds bring together money from multiple investors and invest it on their behalf. This means that when you buy a mutual fund, you are buying a share of the fund itself and the assets it owns, which may be bonds, stocks, or a combination of both.

Key Features Of Mutual Funds

A mutual fund gives you access to multiple assets all at once. This key feature gives you the freedom and full capacity to diversify your portfolio. This saves you from the hassle of having to research, assess, and choose individual securities by yourself.

Some mutual funds are passively managed. They focus on matching the performance of a specific index, or a collection of asset classes such as the ADX General Index. Some mutual funds are actively managed, where professional fund managers select, build, and manage a portfolio of stocks targeting a specific benchmark.

Note – While many refer to the past performance of a fund to assess future returns, they are not as important as one might think. However, they can tell you how volatile or stable a fund has been over a period of time. Different funds feature different risk-to-return profiles. In general, the higher the return potential, the higher the risk of losing money.

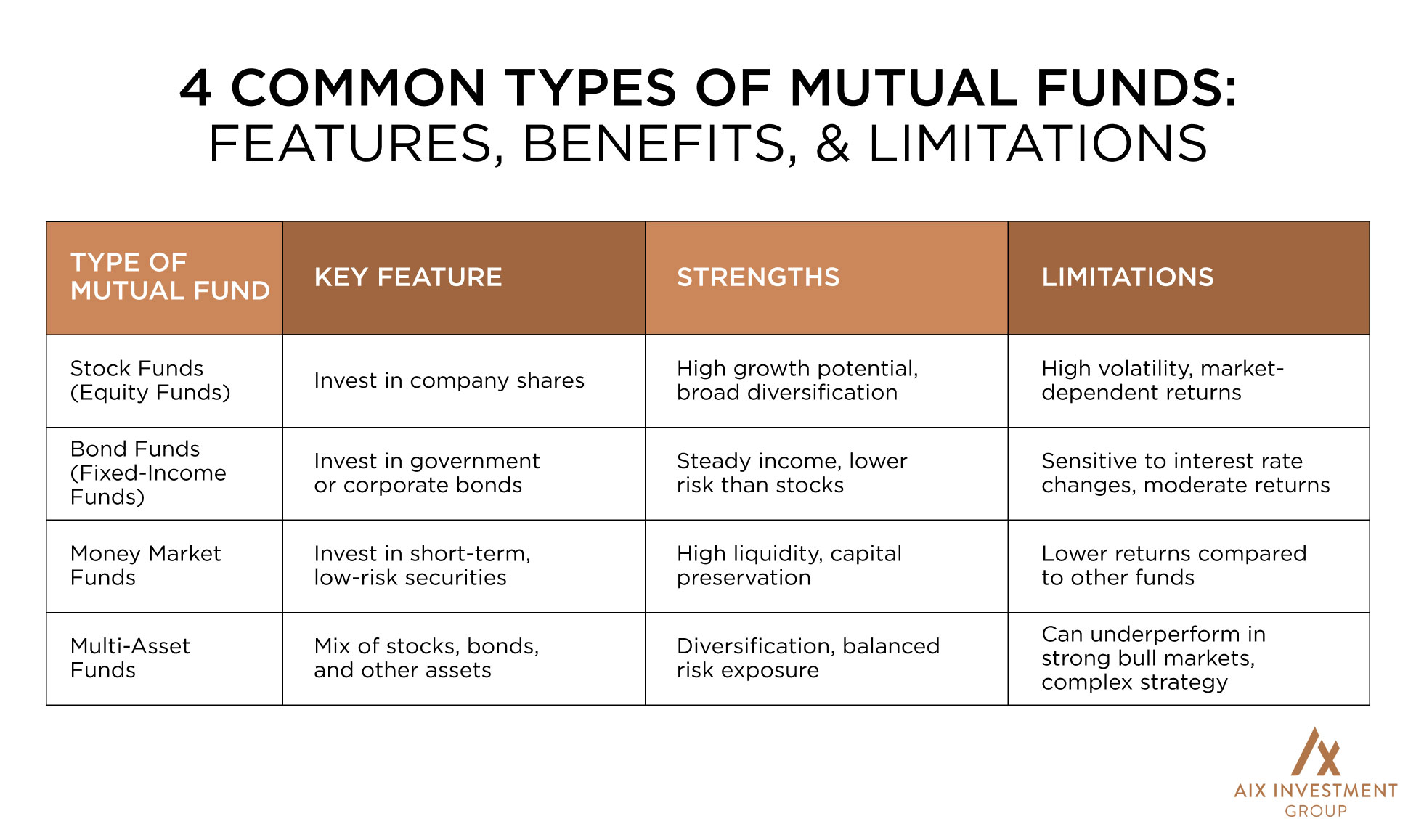

As the name suggests, these are mutual funds that primarily invest in equities in the stock market. Stock funds may focus on tracking a broad market index like the S&P 500 or a particular sector such as technology or healthcare. These mutual funds may also follow a specific investment theme like dividend-paying stocks.

Stock funds, also called equity funds, offer a high capital appreciation over the long term but they also come with greater risk and volatility compared to other types of mutual funds

Bond funds, also known as fixed-income funds, invest in debt securities issued by governments, corporations, and other entities. Returns from this type of mutual fund vary depending on the type of bonds held. For example, government bonds are typically low-risk with proportionately lower returns, while corporate or high-yield bonds offer higher returns but come with greater risk.

These mutual funds generate income primarily through interest payments and are generally considered less risky than stock funds. Bond funds are often used to provide steady income and to balance risk within an investment portfolio.

Money market funds invest in short-term, high-quality securities issued by governments and corporations, such as treasury bills, commercial paper, and certificates of deposit. This type of mutual fund is considered low-risk investments with a focus on capital preservation.

Since money market funds feature high liquidity, they’re a popular choice for conservative investors who want a safe place to hold cash temporarily. While this mutual fund offers lower returns compared to others, it performs well in preserving capital and provides quick access to the funds when needed.

Multi-Asset Funds invest in a combination of two or more asset classes, such as equities, bonds, real estate, and cash equivalents, providing greater diversification than single-asset funds.

The allocation across various asset classes is flexible and determined by the fund manager’s assessment of market conditions with the goal of optimising risk-adjusted returns. By spreading investments, multi-asset funds help reduce risk and smooth out returns over time. They are well-suited for investors seeking balanced growth with moderate risk exposure.

The fees and investing costs associated with mutual funds directly impact your net returns, so understanding them is crucial. They generally fall into three categories:

One of the most challenging steps in learning how to invest in mutual funds in Dubai is selecting the fund that best fits your needs. With so many options available, it’s important to ensure the fund aligns with your financial goals, budget, and investment timeline.

The primary goal of investing in mutual funds is to get good value for your money. Always consider management fees and other charges when assessing potential returns.

Start by reviewing the mutual fund’s:

These details are usually available free of charge on the mutual fund’s official website or through regulatory authorities.

Evaluate your current financial position and discern whether the fund aligns with future plans, timeframe, and risk appetite. To narrow down your investment options further, weigh the benefits and limitations, and ask questions about anything you don’t understand.

Keep in mind that when investing in mutual funds, you are entrusting your money to someone else. You have the right to demand transparency from your fund manager about:

Ensure everything is clearly communicated before pushing through with your investment.

Investing in mutual funds is one of the best ways to build a diversified and professionally managed portfolio. As with any investment, proper guidance and support are necessary to maximize returns and ensure it aligns with your long-term goals. This is where we, at AIX, as one of the leading financial advisory and consultancy firms, can help with your investment journey.

We take the time to understand your financial goals, personal risk appetite, and investment preferences, and align them with market conditions to craft a strategy that truly works for you.

You can talk to one of our associates at +971 56 732 7222 or make an online inquiry, and we will get back to you at our earliest.

Yes, it is. They are especially effective for those who are looking to diversify their portfolio and get benefit from professional management. They are ideal for those seeking long-term growth, with a moderate risk profile and potential returns. However, as with any investments, it is important to research and choose funds that align with your goals, risk tolerance, and cost estimate.

It depends primarily on your financial goals and risk appetite. While equity funds offer higher returns, they also come with high risk. On the other hand, debt funds provide more stability, and hybrid funds combine both.

Generally, mutual funds are a safe investment option. Still, it is important to remember that they are market-linked investments that depend on factors such as economic conditions, global market patterns, etc. If you take the discipline to manage your mutual funds with proper knowledge and guidance, you can maximize your returns.

Yes. These dividends represent the investor’s share of the income the fund earns from sources such as interest, dividends from stocks, or capital gains from selling securities within the portfolio. By law, mutual funds are required to distribute most of their income and capital gains to shareholders, typically on a monthly, quarterly, or annual basis, depending on the fund.

To evaluate a mutual fund’s performance, compare it to other funds using key metrics such as benchmarks, portfolio turnover ratio, and expense ratio. Additionally, review accounting reports, read fund facts, and consider getting professional advice from a financial advisor.

Overview