Forex, or FX, refers to Foreign Exchange. It works on the simple concept of exchanging one currency for another. Assume you have travelled to another country, converted your money to the currency of the country you are in and purchased something online – then you have participated in the forex markets.

Foreign exchange (forex) impacts various areas, affecting both individuals and organizations on multiple levels.

The Forex market is a thrilling trading environment operating 24/5 with a daily trading volumes of trillions of dollars. It is by far the most significant and most liquid of all financial markets.

Forex investment can be explained as a network of buyers and sellers who transfer currencies with each other at a mutually agreed price. It is also how individuals, companies, and central banks convert one currency to another.

While a lot of Forex investment is done for practical purposes, most of this currency conversion is done to earn a profit. The amount of currency converted daily can make the price movements of certain currencies highly volatile. This volatility is what makes forex an attractive investment option for traders as it comes with a high risk and high return profile.

The majority of the Forex investment is done between institutional traders, like banks, fund managers, and multinational companies. They don’t essentially intend or aim to own or take physical possession of these currencies. Instead, they speculate about or hedge against currency movements, aiming to profit from it.

For example, a person planning to invest in forex can buy U.S. dollars and sell euros if they believe the dollar will appreciate or strengthen in value, thereby allowing them to buy more euros in the future.

The FX market does not have a centralised marketplace. Instead, it comprises an international network of major banks and currency dealers, each making a market in a range of currencies in a truly internationalised market.

The FX market is open 24 hours a day, although it is not always active the entire day. The FX market can be broken up into four major trading sessions – the Sydney session, the Tokyo session, the London session, and the New York session.

Here is a list of terminologies you should be aware of when getting started with or learning what is forex investment.

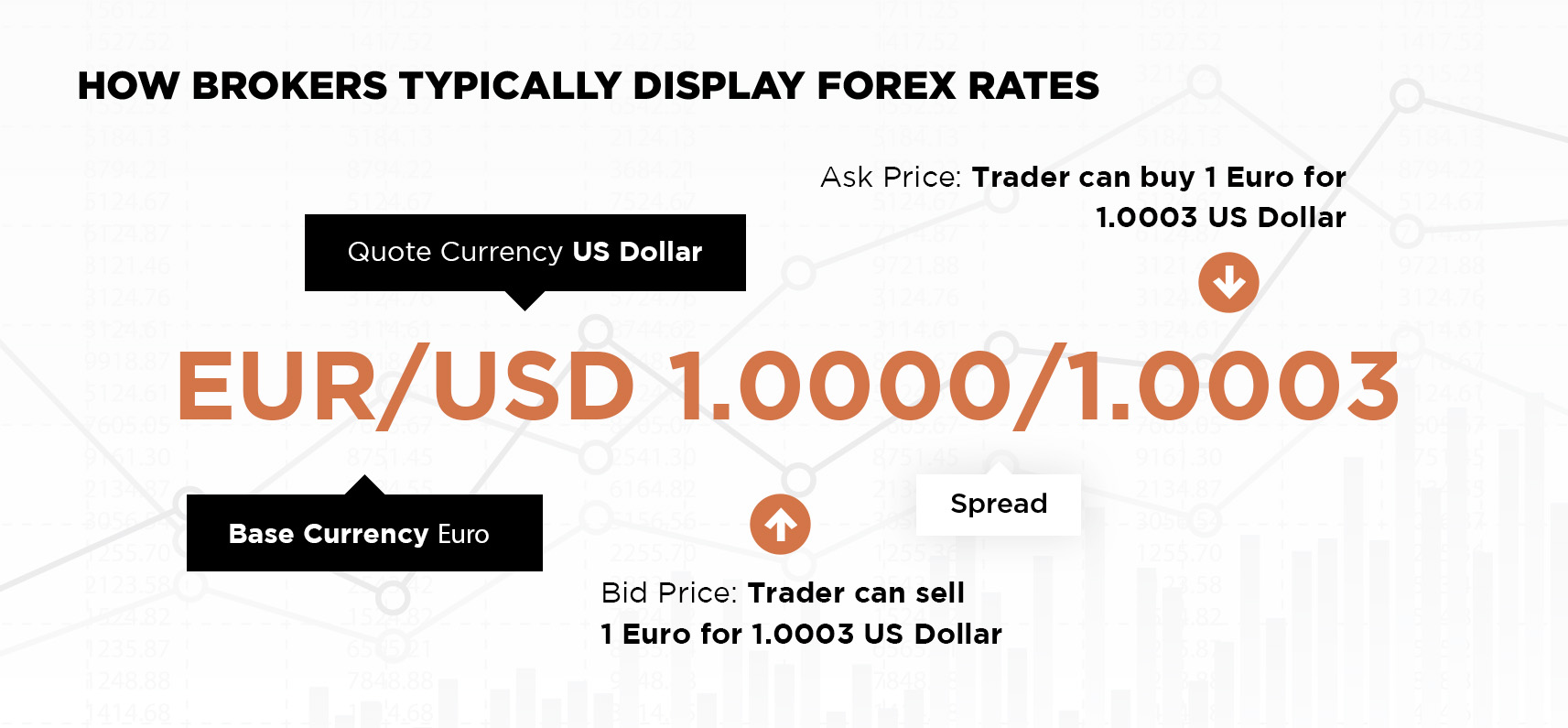

This represents the Euro / US dollar currency pair. The first currency (EUR) is the base currency, and the second currency (USD) is the quote currency.

In the Forex market, there are always two prices displayed, represented as a Forex quote. In the image reference above, the first value (1.0000) is the bid price. It represents the price that the broker will pay a seller for the base currency. The second value (1.0003) is the ask price. It is the price at which the broker sells the base currency. Usually the bid price is always lower than the asking price.

The difference between the bid and ask prices will give what is known as the “Spread”. It represents the cost of a forex trade. In the given example, the spread equals 1.0003-1.0000=0.0003 or 3 Pips.

A “Lot” is a unit of measurement. Forex is traded in lot sizes like Standard (100,000 units), Mini (10,000 units), Micro (1,000 units), and Nano (100 units).

Leverage is like a loan option offered by retail brokers. It gives traders the convenience and opportunity to trade with much higher capital than they have. For instance, with $1,000 of capital and leverage of 100:1, you can open trades to the value of $100,000.

The margin is the amount of capital required to open a leveraged position in the Forex market. As for the example (leverage), $1,000 is the margin required to open a $100,000 leveraged position in the market.

This term represents the ratio of your account equity (capital) to the used margin. Generally, the higher the margin level, the healthier your account, and vice versa.

When you open a trade and it has exposure to the market, it is known as holding a position. When you learn more about what is a forex investment, you will often see descriptions such as “opening a position” or “selling a position”.

As with any other investment market, Forex investments are affected by forces of supply and demand. Here are some of the factors that can move forex markets.

Central banks’ interest rate decisions are one of the most significant factors affecting forex markets. News releases, especially those with updates on economic indicators like inflation, CPI data, GDP, employment data, trade balances, and Government Debts, represent major catalysts of significant price movements in the forex market.

This indicates a measure of how the majority of market participants feel about the market. Typically, a forex investment market can be bullish (rising), bearish (declining), or neutral at any given time.

Government fiscal policies, geopolitical events and countries with stable governments and predictable policies attract foreign investments and impact economic growth and inflation, affecting currency values.

Making the transition from understanding what is a Forex investment to how to start with Forex investments requires you to understand its benefits thoroughly. Here is why many professional and emerging investors see Forex as an ideal investment opportunity in these testing times.

The Forex market is the most liquid financial market in the world, with trillions of dollars traded daily. This also means investors can buy and sell with ease and trade with minimal price fluctuations, even for large orders.

Traders can respond to news and events immediately without waiting for a market to open. This allows for greater flexibility and the ability to trade at almost any time of day.

You can open much larger positions with less capital for more profit – earning potential.

No single entity can control, influence, affect, or corner the massive global forex markets.

Forex traders can engage in a wide range of trading strategies and products, including spot trading, futures, options, and exchange-traded funds (ETFs).

Overview