Cryptocurrency has rapidly emerged as a popular investment option in recent years, providing access to diverse digital markets through both direct ownership and financial instruments that don’t require holding the underlying asset.

The crypto landscape, however, is fast-moving, with new coins launching regularly- making it daunting for first-time investors to navigate. This article provides a clear, beginner-friendly guide to crypto trading, covering what it is, how to buy and sell cryptocurrency, and the key considerations before investing.

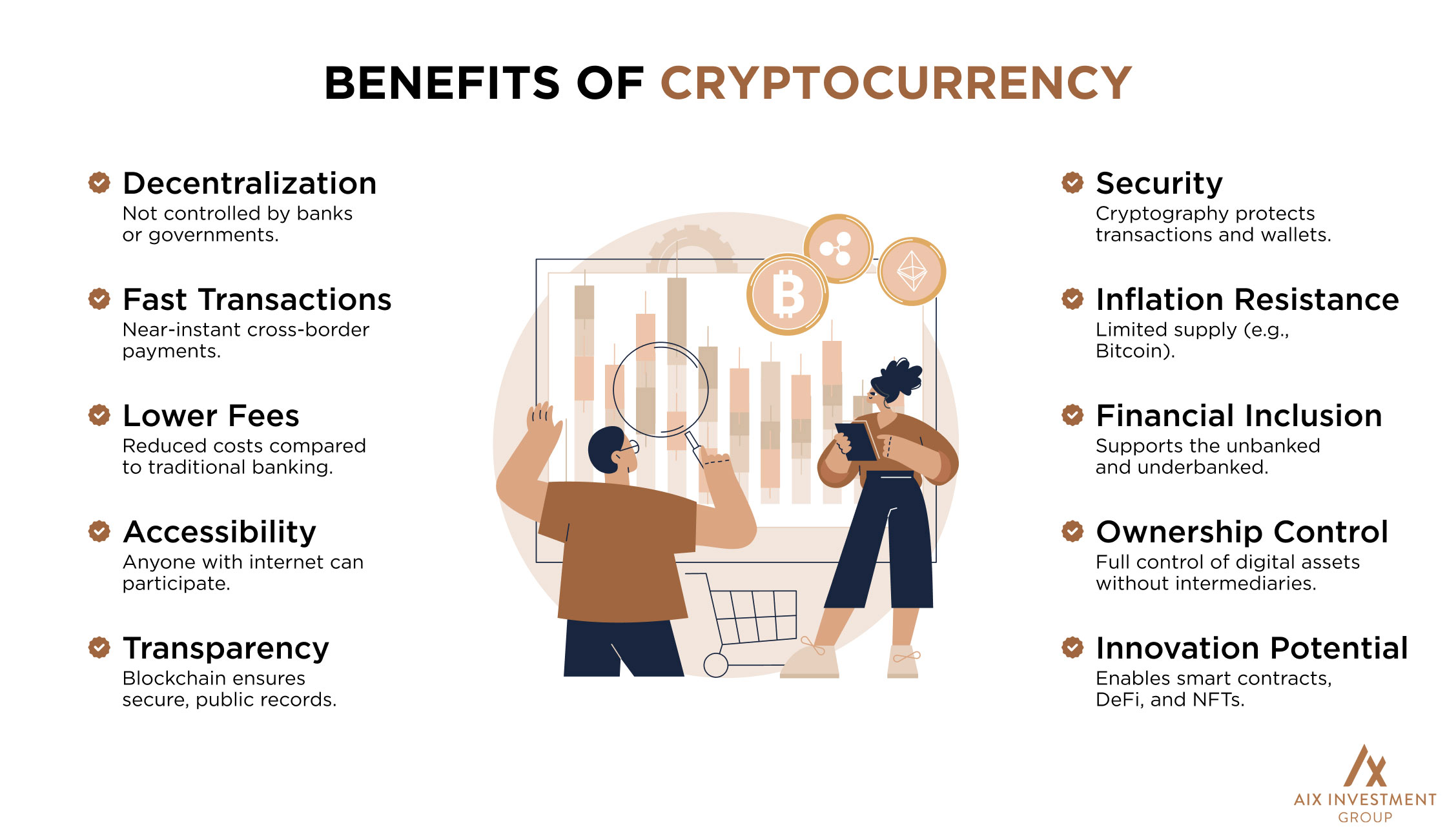

Cryptocurrencies, in simple terms, are digital assets built on blockchain technology. They can be used for a wide range of purposes, including online purchases, investments, and transferring assets across borders- all without relying on banks or other intermediaries.

Following a decentralised approach, cryptocurrencies run on a network of computers rather than being controlled by a single central authority. This provides investors with 24/7 access to trading, unlike traditional shares that can only be traded during specific market hours.

Both cryptocurrency trading and investing involve buying crypto at an estimated low cost and then selling at a higher price. The primary difference lies in the duration for which the asset is held.

If you’re looking to buy and sell cryptocurrency, it’s essential to start with a basic understanding of how the market works. Below are the key steps to help you get started:

1. Choose a Reputable Cryptocurrency Exchange

Select a trusted cryptocurrency exchange platform to avoid costly mistakes when buying or selling digital assets. While regulation of cryptocurrency platforms has improved in many countries, choosing platforms with strong regulatory compliance offers added security for your investments. Consider factors such as trading volume, track record over the past 5 to 10 years, and how the platform stores and secures assets.

2. Create an Account and Verify Your Identity

Set up a secure trading account with your chosen cryptocurrency exchange. You’ll need to complete an identity verification process, as part of the Know Your Customer (KYC) regulations. This typically involves submitting personal information such as your Social Security Number (or local equivalent), a valid ID, and your email address. This step ensures regulatory compliance, helps prevent fraud, and protects your account from unauthorized access.

3. Deposit Fiat Currency Into Your Account

Once verified, connect your bank account and deposit fiat currency (government-issued money such as U.S. dollars, euros, or pounds). These funds will appear in your exchange wallet and can be used to purchase your first cryptocurrency directly on the platform.

4. Buy, Sell, and Swap Cryptocurrencies

Choose the cryptocurrency you want to trade, identified by its ticker symbol (e.g., Bitcoin is BTC, Ethereum is ETH). Before trading, research the coin to ensure it aligns with your investment goals, risk tolerance, and market outlook. Once ready, select the coin, enter the amount you wish to buy or sell, and confirm the transaction. Many platforms also allow you to swap one cryptocurrency for another directly, without converting back to fiat currency.

For beginners, buying a small fraction of a major cryptocurrency is advised. This can help ease your way into crypto trading. When selling, you can either convert your crypto back into fiat currency or exchange it for another cryptocurrency. Many traders buy and sell cryptocurrency frequently to capitalize on price fluctuations.

5. Monitor Your Account and Trade History

Crypto markets generally move in cycles of accumulation, markup, distribution, and decline. Tracking your account balance and price movements helps you understand trends and make better trading decisions.

Over time, you’ll develop strategies that fit your goals, whether securing gains or limiting losses. This exposure is crucial in identifying the right time periods and stages to buy and sell cryptocurrency, as well as when it’s best to withdraw money from your portfolio.

6. Withdraw Your Cryptocurrency Into A Wallet

When you’re ready to cash out, follow the withdrawal process of your exchange platform to access the value of your trade. You can transfer the funds directly to your bank account or move them into a private crypto wallet for safekeeping. This is done through the “transfer” or “withdraw” sections of the platform.

Experienced traders often use derivatives like CFDs (Contracts for Difference) to gain leveraged exposure to cryptocurrency price movements. By analysing price patterns and trends, traders attempt to identify opportunities and profit from both rising and falling markets.

It is essential to note that cryptocurrency CFDs are based on the price of the underlying assets, which are highly susceptible to sudden price fluctuations due to unexpected events and shifting market patterns. This creates significant volatility, which can make crypto trading and leveraged CFDs generally risky.

Here are common reasons why crypto traders use CFDs:

There is no foolproof way to succeed in crypto trading 100 percent of the time, but following these tips can greatly improve your ability to maximize your returns and minimize your losses.

1. Timing is Everything

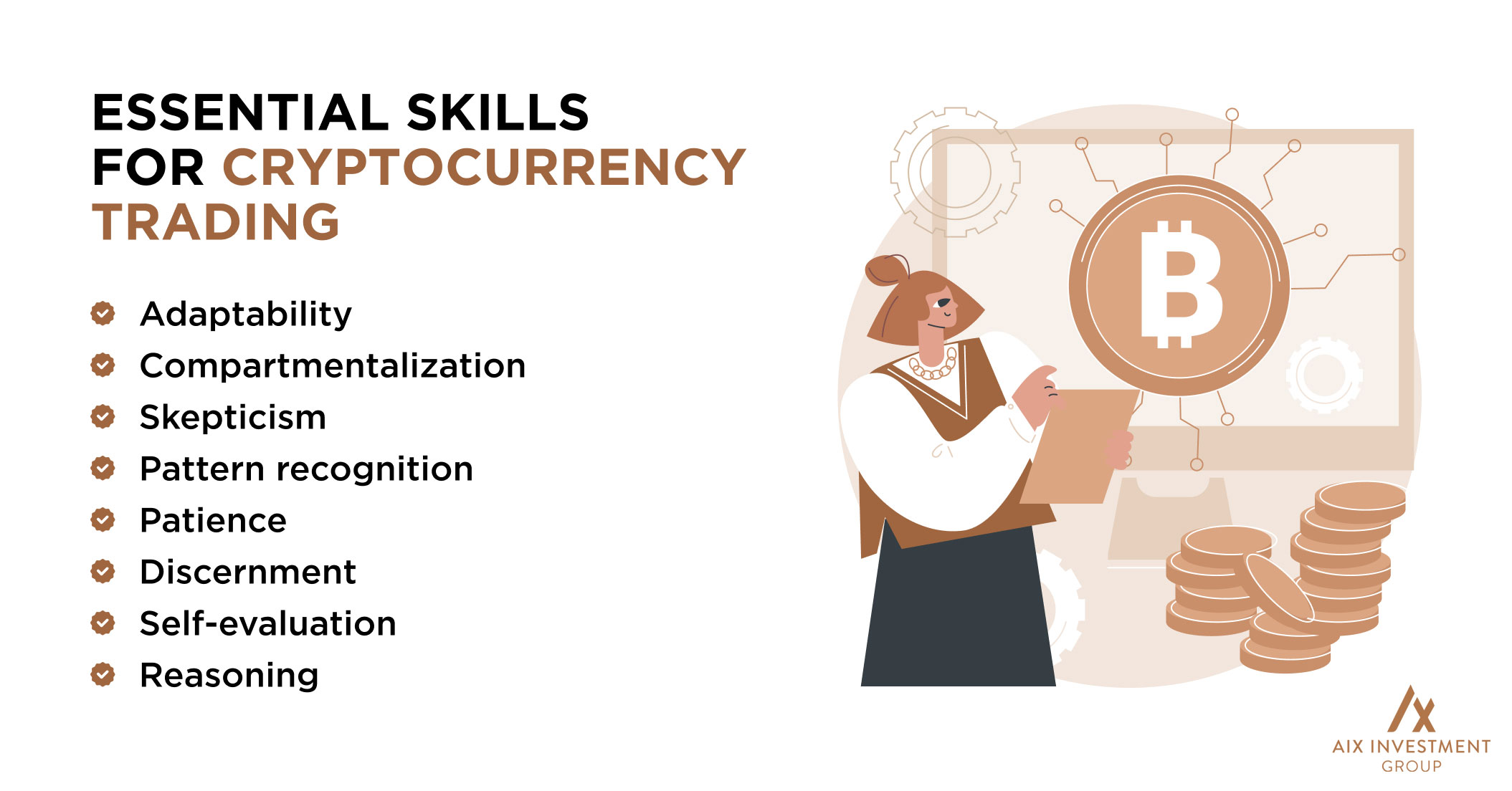

Understanding market trends can help you identify the best time to trade cryptocurrency. Keep in mind that crypto markets move in cycles. Assess the long-term performance of a particular coin and aim to buy when prices are expected to dip at their lowest for a given time period to maximize your returns.

2. Be Patient Until the Right Opportunity Arises

New opportunities in crypto trading usually generate a lot of buzz, and it’s easy to get caught up in the excitement and make a choice that isn’t right for you. Research and wait for investments that align with your strategy.

3. Learn Technical Analysis

Technical analysis in crypto trading involves understanding chart patterns and indicators that help anticipate price movements. This data allows you to identify potential opportunities to buy and sell cryptocurrency and reveal broader trends worth watching.

4. Plan Your Entry and Exit Strategy

Set clear target prices for buying and selling cryptocurrency. Define how much loss you’re willing to tolerate so emotions don’t drive your decisions.

5. Diversify Your Portfolio

There are many cryptocurrencies on the market, each with its own risks and benefits. Spread investments across multiple coins to balance risks. Diversification reduces the impact if one cryptocurrency drops sharply in value.

6. Be Ready To Handle Risk

Crypto trading is generally considered riskier than many traditional assets, such as real estate or stocks. As with any investment, proceed with caution. Only invest money you can afford to lose to protect yourself financially.

7. Think Long-Term

The crypto market is notoriously volatile, with prices often swinging for months at a time. Approach your investments with a long-term perspective. That way, you stay calm during downturns and avoid panic selling.

8. Stay Disciplined

Choose the right coins, continue learning effective strategies to buy and sell cryptocurrency, and trade consistently. This discipline helps you stay on track and reach your financial goals with crypto trading over time.

Exploring emerging investment options, like cryptocurrency, can be both exciting and overwhelming. Understanding market dynamics, monitoring favorable patterns, and making informed decisions often requires extensive knowledge and comes with trial and error. This is where working with reliable financial advisors and consulting firms, such as AIX, is beneficial.

At AIX, we believe achieving financial freedom should be simple, sustainable, and transparent.

We ensure our clients are fully informed and educated in every decision we recommend; empowered with the right tools and supported with clear guidance at every step.

Our expertise in the global investment industry enables us to identify and maximize favorable investment options, aligning them with your unique financial goals and risk tolerance.

The top 10 cryptocurrencies in the world are:

As of October 6, 2025, the exchange rate for 1 US Dollar (USD) is approximately 0.0000080 Bitcoin (BTC).This means 1 BTC is worth around $124,971 USD. Please note that cryptocurrency prices are highly volatile and can change rapidly throughout the day.

Bitcoin has no CEO, central authority, or governing institution. It is a decentralized digital currency that isn’t controlled by any individual or organization. Bitcoin was created in 2009 by an anonymous person or a group and has been maintained and developed by a global community of developers, miners, and users.

Ethereum is the second famous cryptocurrency next to Bitcoin. It took the successful features of Bitcoin and added more functionality. While Bitcoin is used only to trade virtual currency in a decentralized and public way, Ethereum uses decentralized tokens and applications in addition to currency.

The United Arab Emirates, along with countries like the Philippines, Singapore, and Brazil, is leading the way in building a crypto-friendly environment through government initiatives. They are striving to be at the forefront of digital innovation and are actively promoting their citizens to use cryptocurrencies and blockchain technology.

Overview