The increasing focus on financial literacy worldwide is inspiring more people to prioritize money management, recognizing the potential of investing to grow their wealth and secure their futures. Knowing where to invest money is crucial to utilizing all of its amazing opportunities, especially in a country like the UAE, which is considered a business hub and an investment powerhouse in the Middle East.

Achieving financial freedom is a personal journey that requires dedication and commitment. Investment is an art that cannot be learned overnight. It requires a deep learning curve and many trial-and-errors, alongside effective strategies and prompt decision-making.

In general, more than half of the millionaires in the UAE and around the world are self-made, having accumulated their wealth without relying on family inheritance. All of them had one thing in common – they believed that engaging in regular and consistent investing over a long period was the key to their success.

As we step into 2025 with new goals, the investment landscape in the UAE is also poised for new trends, markets, and emerging sectors, which are expected to deliver promising returns.

In this blog, we have gathered insights from financial advisors and investment experts to help you understand how to invest money in the UAE, narrow down the best options for 2025, and provide tested strategies for beginners to grow their wealth this year.

The key to achieving financial freedom and growing wealth is creating a gap between your income and expenses and then investing the surplus in something that produces profitable returns or appreciates in value over time.

Most people who are looking to start their journey with investments focus on the second part, i.e., investing the surplus before pulling their finances and expenses together to create the expected gap. This is one of the primary reasons why the majority of the people who start investing fail.

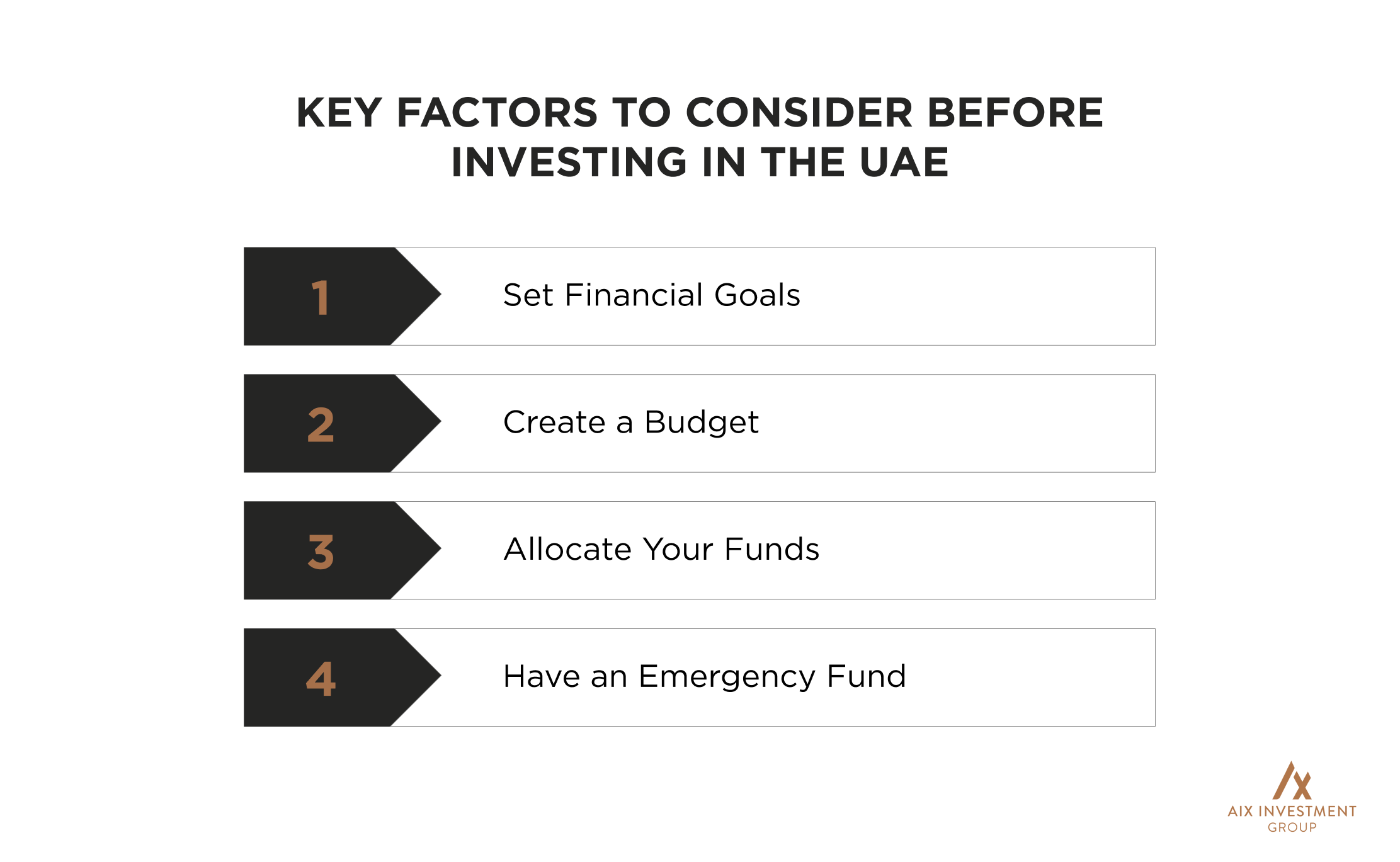

Here are three key approaches you should take to set the right foundation for your investment and create a healthy gap between your income and expenses.

First things first, set a financial goal. Whether you are saving for retirement, an educational fund, or buying a house, make sure you have a defined goal that complies with the SMART principles (Specific, Measurable, Attainable, Realistic, and Timely). By linking your financial decisions to a defined purpose, you are more likely to stay disciplined and committed to your plan, which helps you to be mindful of your expenses and how you manage your income. Most importantly, it allows you to set priorities straight when it comes to money management.

One of the best ways to create a gap in your expenses and income is to have a budget. It is also a highly effective way to pull your finances together and keep you disciplined towards reaching your goals. A well-structured budget is a roadmap that tells you where to allocate your money instead of wondering where it was actually spent.

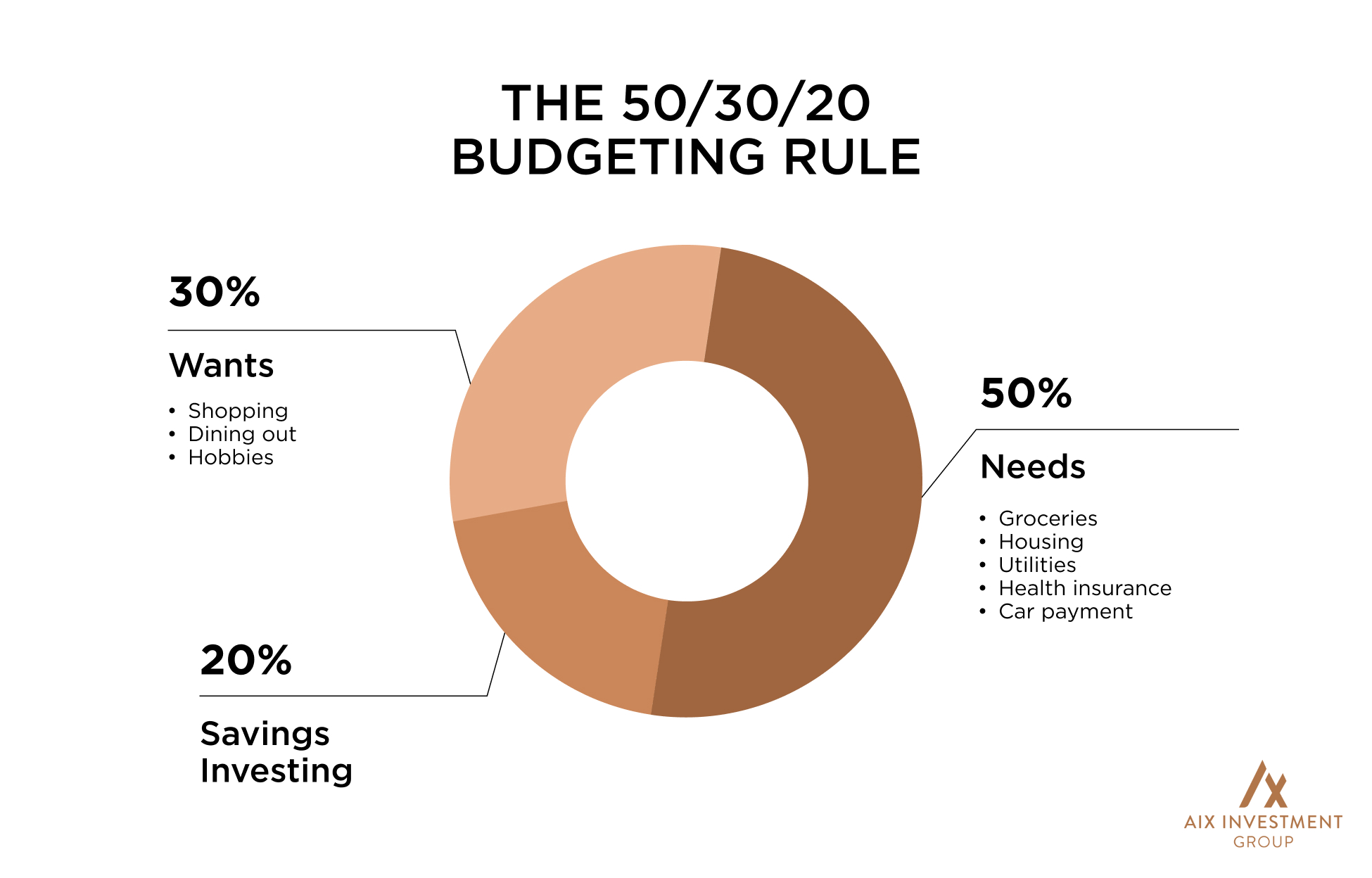

The 50/30/20 budgeting rule is a popular approach that helps you allocate your financial resources appropriately. This method means setting aside 50% of your budget for essentials, such as rent or mortgage, food, clothing, and utilities, and 30% for personal wants, which include hobbies, going out, entertainment, and the like. The remaining 20% is your monthly savings.

Although the savings round up to a small percentage of your salary or monthly earnings, it is one of the most important aspects of budgeting as it aims to ensure that you are spending less than you earn.

A good practice of budgeting goes beyond creating it, requiring the discipline to actually stick to it. The best way to do this is to set aside a percentage of your income for savings before spending.

It is recommended that you have a separate account for savings. Upon receiving your salary or income, deposit a percentage of it into your savings account, then work with what’s left for your expenses, prioritizing your needs over wants. Doing so will help minimize the temptation to overspend.

Being proactive and prepared for life’s unpredictable moments allows you to handle them more effectively. In simple terms, an emergency fund is the money you set aside for unexpected expenses resulting from job loss, medical crises, natural disasters, unplanned repairs, etc.

Without an emergency fund, you risk using the money allocated for investments to address these unforeseen mishaps. Being unprepared for emergencies also means you will likely rack up credit card debt and pay higher interest on it.

To eliminate these risks, consider putting up an emergency fund. Financial advisors recommend that an emergency fund should have at least six months’ worth of living expenses for both needs and wants.

The primary goal behind having an emergency fund is to be a financial safety net, granting you ease of access to cash assets or liquidity in critical situations rather than making a profit. However, this fund must only be accessible in times of need.

Real Estate is one of the most time-tested investments, especially in the UAE, as the country remains an ideal hub for buying properties. Many high-net-worth individuals (HNWIs) have accumulated wealth and created successful portfolios in UAE real estate, and the market seems promising for 2025 and beyond.

While real estate stands out as an ideal investment, it may not be the best option for beginners. This is because real estate requires a huge capital outlay, and diversification is hard as you require a lot of money. Moreover, it also comes with difficulties in areas such as managing tenants, hidden and complex fee structures, and an illiquid market–difficulty selling or converting properties into cash due to a lack of interested buyers.

Beginners are recommended to start investing with Real Estate Investment Trusts (REITs). REIT is a company that owns and operates income-producing real estate, which can be either commercial or residential.

REITs are bought and sold just like the shares of any other company. This means that you will only hold shares of the companies that are buying real estate (including mortgage lenders) instead of buying properties with a huge investment and managing them. REITs are traded on a stock exchange in the same way as any other shares. This means that they are liquid, and so are easy to buy and sell and can be readily realized.

These companies may own and operate income-generating properties, such as office buildings, shopping malls, and apartments (Equity REIT), or provide financing to real estate owners through mortgage (Mortgage REIT). By investing in REITs, you can benefit from real estate market returns without the complexities of direct property ownership.

REITs are a great option for anyone looking for secure opportunities to invest money in the UAE in 2025. This way, you gain exposure to real estate without the risks of owning a property. You will earn money in the form of dividends and by the appreciation in the price of the REIT. The dividends are often regular, ensuring a steady source of income.

The best way to invest in REITs is by buying them through ETFs (Exchange Traded Funds). Buying individual REITs has the same disadvantages as buying individual stocks, whereas ETFs allow you to diversify your portfolio across many REITs, helping to mitigate potential volatility.

A bond is a debt instrument that private companies or government entities issue to raise capital. The three major types of bonds are as follows:

There are two main ways to make money by investing in bonds. The first is through interest payments, where the bond issuer pays the bondholders at regular intervals. Unlike stocks, bonds have a fixed interest rate. You can also earn returns from bonds as their value grows or appreciates.

When interest rates drop, bonds with higher rates become more valuable because new bonds offer lower returns. This means you can sell your older, higher-interest bond for a profit. Additionally, when the stock market is struggling, more people invest in bonds, which increases their demand and often pushes their prices higher.

In general, bonds are issued for a long period, but unlike stocks, they can only be held for a predefined term—not forever (unless the company repurchases them).It provides a consistent stream of income for a certain period depending on the type of bond, such as 10-year or 20-year bonds.

You also have the option to earn by selling them at a higher price than what you paid for them before maturity. In comparison to other types of investment options available in the market, bonds are generally considered one of the least volatile options. They are typically used to counterbalance stock investments. However, the lower risk profile may translate to smaller returns.

As a diversification strategy in your investment portfolio, bonds offer many benefits and serve as a cushion when the stock market hits a rough patch. To safeguard and maximize your assets, make sure to conduct diligent research to understand if the company has a low-risk profile, as defined by bond rating agencies.

Stock refers to a share of a company’s earnings and assets that individuals and institutional investors can buy. Owning shares of stock is another lucrative investment option in the UAE in 2025 because it basically means you’re entitled to a portion of the company. Investors can make money from stock ownership in two ways:

Gold has always maintained its reputation as one of the best investments, not just in the UAE but globally. Since its supply is limited and cannot be increased arbitrarily, gold is considered a store of value, meaning its value remains steady and will not decline over time.

Gold is commonly sought after by investors for unforeseen situations or periods of deflation, inflation, and recession. Unlike other forms of currency, gold is not subject to downward pressures or market crashes. In fact, gold proved its advantage as a strong inflation hedge during the 1970s and as a refuge during the deflation of the Great Depression.

According to Forbes, gold as an investment option has also outperformed the S&P 500 (Standard & Poor’s 500) index in six of the eight recessions between 1973 and 2020. With increasing uncertainties in global economies and growing inflationary pressures, gold continues to prove its resilience.

The pattern of gold’s value to remain stable or continue to rise, especially during a financial crisis like a recession, which is also a period when stocks tend to underperform, has made it a safe haven for many investors (just like bonds.) Owning gold is also an effective strategy to diversify their investment portfolios.

There are many ways you can invest in Gold, such as gold bullion (tangible gold), stocks of gold companies (similar to REITs), gold mutual funds, gold futures and options, and gold ETFs.

It is also important to mention that, regardless of the advantages discussed, Gold also inherits many disadvantages, especially when compared to bonds and REITs. Some of them include:

Cryptocurrencies, which emerged in 2009, initially faced widespread fear and skepticism. This was largely due to their association with illicit activities, extreme price volatility, lack of regulation, technical complexity, and overall newness. Additional concerns included their potential to disrupt the traditional financial system and their environmental impact.

Over the years, the crypto ecosystem has matured significantly, attracting many potential investors. This growth is boosted by factors such as wider adoption, improved regulation, technological advancements, diverse use cases, increased security, environmental awareness, and mainstream recognition.

The outlook for cryptocurrencies in 2025 seems promising, particularly in the UAE, which stands out as a leading destination for crypto investors due to its favorable tax conditions and progressive regulatory environment.

One of the most attractive aspects of crypto investments in the UAE is the absence of taxes on the gains. This policy has attracted both local and international investors, making it one of the best investment options in the UAE for 2025.

If you’re considering entering the cryptocurrency market, you must invest through platforms that comply with UAE regulations, especially those established by the Dubai Virtual Assets Regulatory Authority (VARA). Similarly, trade only on platforms licensed and approved by the UAE authorities to avoid scams and ensure the security of your transactions.

It’s important to note that while the cryptocurrency market is highly regulated in the UAE, effectively navigating it and maximizing returns requires a significant learning curve, often extending beyond just a few months, unless you’re investing with the support of financial advisors. If you’re a beginner seeking less risky investment options in the UAE, bonds and Real Estate Investment Trusts (REITs) may offer more stability.

Beginner investors often hesitate to try cryptocurrency because of its negative stigma, even though it can be safe and legitimate. In this case, Bitcoin can serve as an ideal entry point.

Just like gold, Bitcoin has a limited supply, making it one of the best investment options in the UAE for 2025. It has a good store of value, a potential inflation hedge, and acts as a good option for diversification.

When Bitcoin was first introduced, its potential as an inflation hedge was mostly theoretical due to low inflation levels at the time. However, during the pandemic, many researchers observed that Bitcoin performed well under unstable market conditions. Although its status as a safe haven asset, similar to gold, remains unproven.

Reliable data shows that Bitcoin was a useful diversification tool from 2012 to 2020, maintaining an almost zero correlation with the stock market. However, recent data indicates an increasing correlation, casting doubt on its effectiveness for diversification.

While Bitcoin can offer substantial returns, it also carries a high-risk profile, often reflected in its price volatility. However, some experts argue that, when comparing risk-adjusted returns, Bitcoin tends to have a higher Sharpe ratio than gold and stocks. Overall, despite delivering mixed results, Bitcoin remains one of the most attractive investment options in the UAE. Ultimately, it’s up to you as an investor to decide whether it fits into your portfolio.

If you’re a beginner and feel uncertain about selecting individual stocks or bonds due to limited time or expertise, mutual funds are another good investment option for 2025.

Mutual funds are investment opportunities that pool money from multiple investors and allocate it across a diversified portfolio of stocks, bonds, or other asset classes. These funds are managed by professionals who specialize in navigating market risks and making informed investment decisions on behalf of the investors.

One of the primary benefits of mutual funds is that they offer diversification, reducing the risk by spreading investments across multiple companies or sectors. When you invest in a mutual fund, you own shares of the fund itself– not the individual assets it holds.

Equity funds (stocks), fixed-income funds (bonds), balanced funds (mix of both), and specialty funds (focused on specific sectors or themes) are the common types of mutual funds.

Mutual funds can generate returns in several ways, including the following:

By structure:

By investment strategy:

Exchange-Traded Funds (ETFs) are investment vehicles that hold a mix of assets—such as stocks, bonds, or commodities—providing investors exposure to a diversified portfolio through a single share. ETFs are among the best investment options in the UAE for 2025, especially for those seeking passive income. Over the past few years, they have gained widespread recognition for helping investors build and maintain diversified portfolios at a relatively low cost.

For instance, the iShares Core MSCI EAFE ETF (IEFA) offers broad exposure to companies from developed markets outside the US and Canada. It also covers various industries and company sizes across Europe, Australia, Asia, and the Far East. Some investors choose not to buy individual securities; instead, they use ETFs to build a diversified portfolio more efficiently and at a lower cost.

Owning a single ETF provides access to a wide range of securities, while holding multiple ETFs can further enhance your diversification. For example, an investor might opt to combine ETFs focused on U.S. stocks, international stocks, real estate investment Trusts (REITs), and bonds. This strategy spreads investments across different asset classes and geographic regions, significantly reducing the overall risk of the portfolio.

While investing is the first step toward achieving financial security and freedom, it requires a lot more than meets the eye. Knowledge, expertise, discipline, and consistency are key factors that play a crucial role in the success of your investments.

In today’s fast-paced and ever-evolving investment landscape, mastering the complexities, risks, and uncertainties is no simple feat, especially for beginners. This is where trusted financial advisors like AIX come in, offering expert guidance to help you navigate the market with confidence and clarity.

With first-hand knowledge and experience, you can skip the complex trial-and-error process, making your journey to financial independence faster, more efficient and less stressful. For more information, please get in touch with their support team.

The best investment in the UAE depends on your financial goals, risk tolerance, and investment horizon. Given the current market conditions for 2025, bonds and REITs are among the best investment options in the UAE due to their stable returns, lower risk compared to stocks, and ability to diversify a portfolio.

You can grow your wealth by investing in a diverse portfolio that includes options like ULIPs (Unit Linked Insurance Plans), mutual funds, stocks, real estate, corporate bonds, Gold ETFs, National Savings Certificate, and tax-free bonds, to name a few. However, it is important to assess market conditions, risk tolerance, and individual goals before making a decision.

Below are some great options that have a low risk and high return profile.

However, their performance is shaped by market conditions and your specific goals.

The seven common types of investments include:

Each type varies in terms of risk, potential returns and investment goals.

There are no investments that are 100% safe. Every investment option comes with a risk-to-return ratio. The higher the risk, the higher the return, and vice versa. Some of the low-risk investment options for beginners are:

As a beginner, investing in today’s dynamic market is complex and requires a comprehensive learning process. It cannot be mastered quickly, so it is always best to get expert advice from a financial advisor who can tailor strategies and ensure the investment decisions align with your goals and risk tolerance.

To start investing as a beginner, you need to:

While short-term investing typically involves balancing risk and return, some popular ways to grow your money in the short term include:

If you are looking to double your money in the next five years, you should have an annual return of 14.4%. This can be achieved by investing in stocks, bonds, mutual funds, and other investment modes, depending on your risk tolerance and market conditions. This estimate is based on the Rule of 72, a simple formula used to calculate how long it will take for an investment to double at a fixed annual rate of return:

Years to Double = 72 / Annual Interest Rate (%)

For example, to double your money in 5 years:

Annual Interest Rate

= 72/5

=14.4%

With a budget of 10,000 AED, you have several investment options to consider:

To make the most of your AED 20,000 investment, consider diversifying across multiple asset types to balance risk and return. Here are some popular options:

Passive income refers to earnings generated with minimal ongoing effort after an initial investment of time, money, or work. In the UAE, common sources of passive income include rental income from properties, dividends from shares in businesses or stocks, royalties from intellectual property such as books, music, or patents, and income from investments like REITs or dividend-paying ETFs.

Some of the best investment options for monthly income include savings accounts, certificates of deposit, annuities, bonds, dividend stocks, rental real estate, and more.

Overview