In today’s fast-paced and interconnected world, financial management has taken center stage in everything we do. Whether you’re planning for a dream vacation, preparing for a stable retirement, or processing student loans, how you manage your finances is crucial now more than ever.

This is one of the primary reasons why there is a growing global emphasis on enhancing financial literacy and raising awareness about the significance of wealth management.

In fact, focusing on wealth and money management today is no longer an option but an essential as we navigate a world shaped by rising inflation, digital currencies, and dynamic job markets.

Wealth management is not just about numbers or figures. It covers a much wider context of life in terms of securing freedom, stability, and the opportunities to create a brighter future.

This article will provide a comprehensive guide to understanding what is wealth management, its context, importance, and how to choose a wealth manager with specific insights into Dubai’s unique appeal as a hub for high-net-worth individuals (HNWIs).

Wealth management refers to the provision of financial services aimed at preserving and growing clients’ wealth, ensuring their financial goals are met over the long term. The provision of these services is typically segmented according to wealth, with clients classified as mass affluent, high net worth, or even ultra-high net worth.

Wealth managers are professionals who offer this service. They cater to a more comprehensive area of focus than a regular financial planner, including retirement planning, tax strategy, estate planning, and risk management.

Professional wealth managers may also collaborate with tax advisors, investment advisors, bankers, business consultants, and philanthropic advisors to provide specialized solutions depending on the client’s unique circumstances.

Wealth management, in simple terms, refers to the management of your assets and accumulated wealth to protect and grow in value with time. This involves using strategies that can create more opportunities for financial growth while keeping your wealth aligned with your financial goals.

Over the last decade, the number of HNWIs in the UAE has surged by 55%, reaching a record net flow of 6,700 millionaires in 2024. This surge is part of a broader trend that has positioned Dubai as the wealthiest city in the Middle East and also one of the top 25 wealthiest cities globally.

In 2025, Dubai will continue to maintain and solidify its reputation as one of the premier destinations for millionaire migration and high-net-worth individuals who are looking for the perfect blend of luxury, financial incentives, security, a tax-free environment, and other strategic advantages. The city, alongside Abu Dhabi and Sharjah, is expected to see over 150% increase in centi-millionaires by 2040.

Dubai and the UAE, in general, have no personal income tax, capital gains tax, or inheritance tax.

Dubai features a strategic gateway between East and West, providing access to global markets.

The city is known for its high-end real estate, world-class amenities, and cosmopolitan lifestyle.

The government constantly maintains a strong, diversified economy focusing on future growth sectors like tech and green energy.

A low crime rate and high levels of personal safety are perfect for raising children and living with the family. The city also offers excellent healthcare, education, and family-friendly amenities, promising a high quality of life.

Booming real estate market and attractive business conditions.

The recent Golden Visa program and other incentives for investors and entrepreneurs make it an attractive option for anyone wanting to live and retire in Dubai.

100% foreign ownership policies and low regulatory barriers make the UAE a highly favorable destination for foreign entrepreneurs and companies.

Dubai International Financial Centre (DIFC) provides access to global financial services.

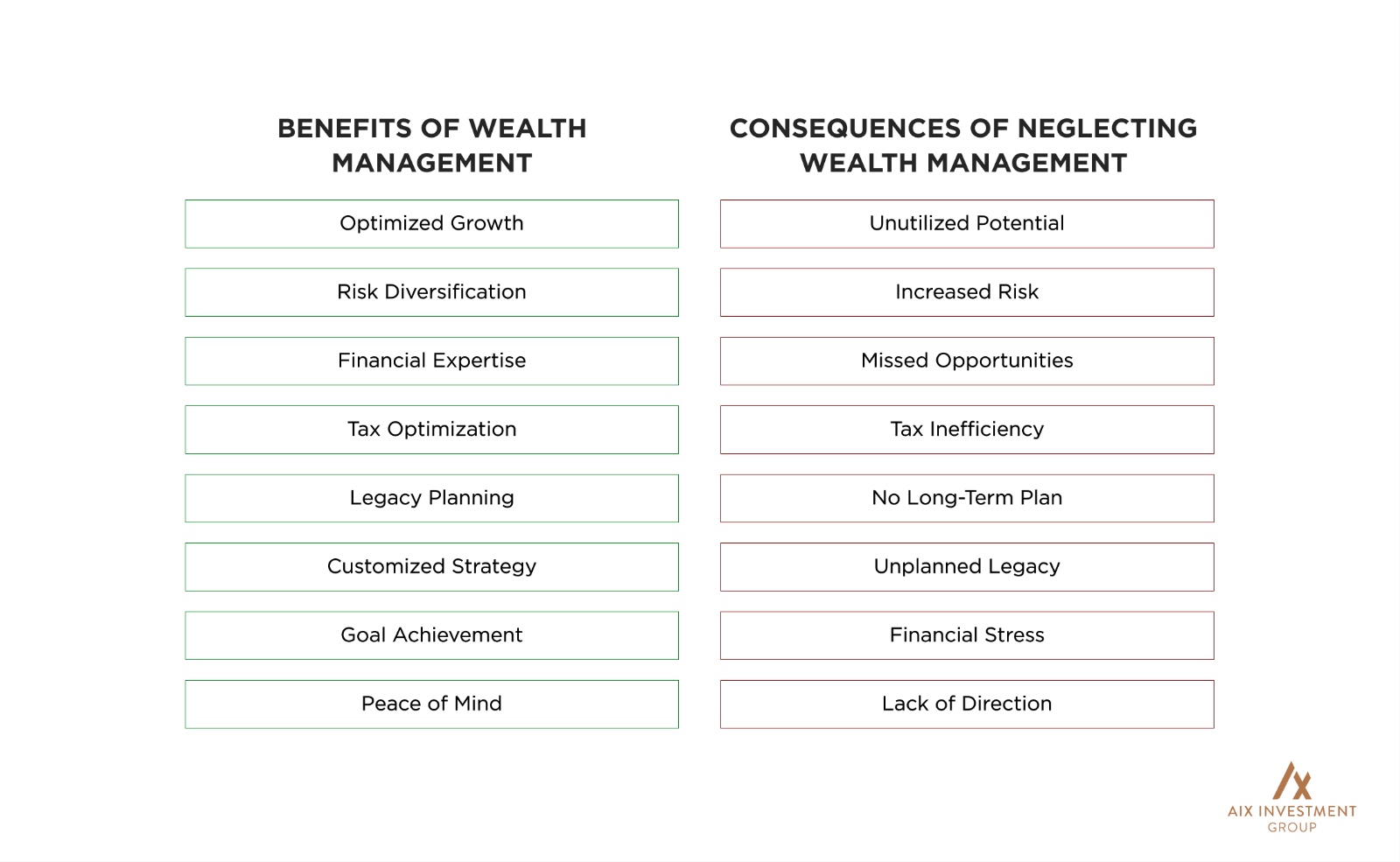

HNWIs often have various needs that require a more strategic and comprehensive approach to financial planning and advising. Here are some of the key benefits of wealth management and its importance.

Effective wealth management helps you identify and capitalize on emerging opportunities supporting financial growth. It allows you to invest your assets using strategies that maximize returns while aligning with your risk tolerance and goals.

With proper wealth management, you can diversify your asset classes, which reduces risk exposure to market volatility. This helps in protecting your wealth from unforeseen risks.

Wealth managers have in-depth and comprehensive knowledge about the highly active and dynamic markets in Dubai. This expertise can help you manage your wealth efficiently by leveraging insights you might not have on your own or find complex to break down.

Wealth management in Dubai focuses on leveraging the city’s tax-free benefits, ensuring legal compliance with international tax obligations, maximizing earnings, and creating opportunities for sustained wealth growth.

Through wealth planning and management, you can preserve your assets and transfer them smoothly for future generations by specifying conditions, goals, and any other personal wishes.

Wealth management follows a tailored approach to guide unique financial goals. This ensures all your financial priorities are considered when planning an approach to managing your wealth.

Effective wealth management allows you to achieve your goals and enjoy financial freedom. Whether you have short—or long-term goals such as buying a house, retiring early or funding your education, wealth management simplifies goal achievement.

With experts handling your wealth, you will have a solid plan that withstands the market volatility in Dubai, keeping you confident and stress-free about your financial future.

It is important to emphasize that most HNWIs in Dubai are expats who need specialized knowledge, including Sharia law, to manage their wealth effectively and ensure compliance. Wealth managers provide essential expertise to ensure expats protect their wealth, navigate complexities, maximize opportunities, and comply with both local and international laws.

Not having proper wealth management strategies can limit the potential in which your wealth can grow. It can also underutilize your wealth, leading to missed opportunities.

Not diversifying your wealth portfolio can expose them to market volatility, reducing returns and even resulting in significant and irreversible losses.

Poor guidance or lack of expertise in wealth management can make you easily overlook opportunities for financial growth, tax savings, or strategic investments.

Wealth management measures without proper analysis can easily lead to tax inefficiencies, resulting in higher liabilities and reducing the overall value or return ratio of your wealth.

Falling behind on proper wealth management initiatives leaves you unprepared for major financial goals like retirement, building a house, or financing for studies.

Lack of effective wealth management strategies can make it complicated to pass down generational wealth. This may also lead to disputes and inefficient asset transfers, potentially causing legal issues.

Wealth that is not managed effectively can cause anxiety and stress over financial decisions. In the long run, this can make you lose control over your future and financial freedom altogether.

Falling behind on wealth management blurs your vision for the future. It makes financial efforts and decisions lack clarity, reducing your ability to grow and secure your wealth.

Wealth management is ideal for both individuals and families who have accumulated significant assets and are looking for professional assistance to secure, grow, and manage their wealth efficiently.

It suits high-net-worth individuals, business owners, professionals and executives, families with inheritance, and anyone with complex financial goals.

In general, wealth management offers value to anyone seeking a customized, holistic financial strategy that keeps up with the market volatility and patterns while aligning with their goals.

Here is what wealth management means based on key factors, service areas they cover, and how it helps HNWIs manage their finances to achieve relevant goals.

Wealth management is a much broader financial concept. It includes almost everything related to finance, from investment management tax strategies to estate planning and simplifying wealth transfers.

The scope of wealth management focuses exclusively on securing accumulated wealth, optimizing it, transferring wealth, and dealing with complex financial situations for high-net-worth individuals (HNWIs) or families with generational wealth.

Wealth management is designed for individuals or families who have significant assets or generational wealth. The ideal client base that requires wealth management is high-net-worth individuals (HNWIs) and business owners with complex financial needs who require expert guidance on managing large portfolios and passing on wealth to future generations.

Wealth management takes a more holistic and comprehensive approach to managing the financial aspects of high-net-worth individuals.

It covers a wide range of services, including investment management, estate planning, tax strategies, and philanthropy. The approach taken towards wealth management follows a long-term focus on preserving and growing wealth across generations.

Wealth management involves a higher cost because it provides a comprehensive range of services, including investments and asset allocation strategies, from evaluating, planning, executing, and monitoring. The cost for the service or free structure may vary based on the assets managed.

Wealth management requires strict regulatory compliance, particularly in areas such as investment advisory, estate planning, and tax management. In many countries, wealth management firms are regulated and overseen by bodies like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) in the U.S. and equivalent regulators in other countries.

This regulatory oversight is essential to ensure transparency, ethical practices, and client protection. The complexity and extensive oversight required for wealth management come from its approach to catering to a wide range of financial services and dealing with high-worth individuals.

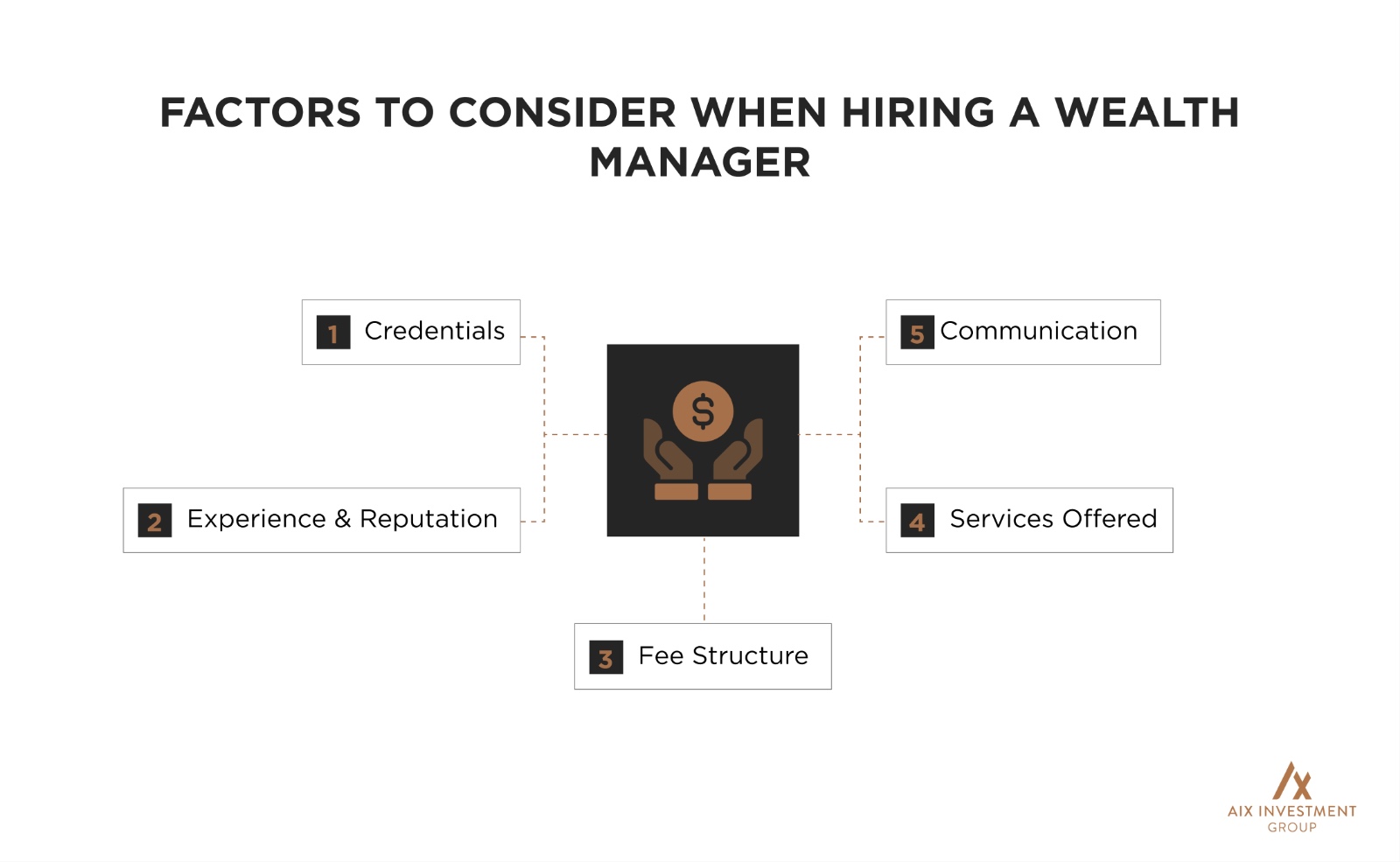

Here are five key factors you need to look into when choosing a wealth manager.

Wealth managers, especially private wealth managers, hold advanced certifications like Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA). Some may also have additional certifications, such as Certified Trust and Financial Advisor(CTFA) or Certified Private Wealth Advisor (CPWA).

They often possess a higher level of education, such as a master’s degree in finance or a related field.

Experienced or well-renowned wealth managers often belong to professional organizations such as the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA).

Whether you are looking for a wealth manager or financial planner, always focus on their experience and reputation. This tells a lot about their capacity to handle complex situations and their deep understanding of versatile strategies to help with your unique goals.

Professionals with years of experience in wealth management possess the valuable insights required to handle client portfolios or guide clients toward their financial objectives. It is also important to consider the reputation of wealth managers, and try to evaluate their success with other clients. They need to be someone you can trust, supported by a high level of regulatory oversight.

The fee structure of wealth managers may vary but usually, they charge a premium for their service and experience. It would also significantly depend on the complexity and type of services required to achieve your specific goal.

Some charge fees based on the assets they manage. This means that the higher the value of the assets, the higher the fees. Always make sure you discuss your budget and have a clear understanding of the wealth manager’s fee structure.

When you choose a wealth manager or financial planner, always have a thorough understanding of their services. Ask as many questions as you want to understand if they have the expertise and capacity to provide the services you need to achieve your financial goal. Transparency about services offered, required, and rendered is crucial to prevent misunderstandings or disappointments. It also helps manage expectations of the ideal outcome.

Apart from financial literacy, choose a wealth manager with great communication skills. Keep in mind that poor communication skills leave room for all types of problems and even losses.Effective communication is also important to build trust, explain complex concepts, and understand your goals. When dealing with any financial advisor, first impressions are important, especially in how they communicate. This goes a long way in building confidence in their ability to manage your financial affairs.

At AIX, we offer personalized wealth management solutions that are tailored to your specific needs. We have a handpicked team of financial advisors with extensive industry experience and a strong commitment to fiduciary responsibility. You can trust that your wealth will be managed with the highest level of integrity and accuracy, always aligned with your financial goals

At AIX, we offer personalized wealth management solutions that are tailored to your specific needs. We have a handpicked team of financial advisors with extensive industry experience and a strong commitment to fiduciary responsibility. You can trust that your wealth will be managed with the highest level of integrity and accuracy, always aligned with your financial goals

Whether you want to focus on investment growth, tax optimization, or long-term strategy planning, we provide customized strategies that will guide you one step closer to your goal.

This depends on your needs and goals. A wealth manager offers a broader range of services for high-net-worth individuals or those who own a complex asset portfolio, while a financial advisor focuses on specific financial planning and investment advice.

The minimum amount you require to get a wealth management service will be different from one wealth management firm to another. In general, $2- $5 million in assets is the minimum range where it makes sense to consider the services of a wealth management firm.

Yes, it is, especially in the context of Dubai, where most expats are HNWIs, wealth management helps with legal compliance, preservation of assets, and optimizing opportunities. In general, wealth management services offer you not just the knowledge to make effective financial decisions but also the experience, tools, and objective viewpoint you need to develop a perceptive strategy.

Yes. Financial planning is to guide people toward a specific financial goal or strategy. In contrast, wealth managers cater to clients with more complex financial situations and higher net worth.

The cost or fee structure for wealth management often has two types: fee-based and fee-only. In a fee-based pricing structure, the wealth manager is compensated with a direct fee from the client and commissions from the sale of recommended products or services. For fee-only pricing, wealth managers are paid solely through client fees and do not receive commissions for selling products or services.

Overview