Risk and uncertainty are two concepts that stem from randomness. Neither is fully understood. Whereas risk is quantifiable randomness, uncertainty isn’t. It applies to situations in which the world is not well-charted. Uncertainty arises from imperfect knowledge about the way the world behaves.

First, our world view might be insufficient from the start. Second, the way the world operates might change so that past observations offer little guidance for the future. Where typically, in situations of choice, risk and uncertainty both apply. Most importantly, uncertainty relates to the questions of how to deal with the unprecedented, and whether the world will behave tomorrow in the way as it behaved in the past.

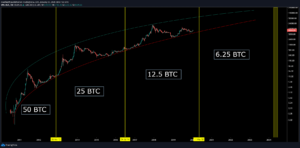

Bitcoin had its third halving since creation. It means that the reward for unlocking a “block” has been cut from 12.5 new coins to 6.25.

So called halving is written into the Digital Assets’ code by its creator to control inflation and happens approximately every 4 years and the next one is expected in 2024.

On the other front, gold prices have been gyrating sideways for the past several weeks, coiling into a symmetrical triangle pattern that favors a move to new highs. Yet traders looking for a catalyst in the April US nonfarm payrolls report, the worst jobs report in the past 80 years came up disappointed with the lack of significant price action. With the initial jobless claims report coming out on a weekly basis, it seems that much of the negative news about the US labor market was discounted. For now, gold prices continue their consolidation just below their yearly highs, weathering the rebound in risk appetite.

Gold prices have a relationship with volatility unlike other asset classes, even including precious metals like silver which have economic uses. While other asset classes like bonds and stocks don’t like increased volatility, signaling greater uncertainty around cash flows, dividends, coupon payments, etc. , gold tends to benefit during periods of higher volatility. Heightened uncertainty in financial markets due to increasing macroeconomic tensions increases the safe haven appeal of gold.

It should be noted that momentum has neutralized in recent days, now that gold prices are enmeshed among the daily 5-, 8-, 13-, and 21-EMA envelope, which is in neither bearish nor bullish sequential order. Daily MACD is falling, albeit in bullish territory, while Slow Stochastic are meagerly rising their median line. The coiling continues. Gold prices have made significant progress within the confines of the multi-year inverse head & shoulders pattern, achieving their highest level since November 2012.

The COT (commitment of traders) data shows 70.09% of traders are net-long while the number of traders net-short is 11.85%. If we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. If gold prices do break higher from here, the near-term measured move calls for gains towards 1834.02. If gold prices break the April 21 low of 1661.42, the measured target is 1575.42.”

Many situations of choice are unprecedented, and uncertainty about the underlying relation between cause and effect is often present. Given that risk is quantifiable, it is not surprising that academic literature on stock market randomness deals exclusively with stock market risk. On the other hand, ignorance of uncertainty may be hazardous to the investor’s financial health.

It’s difficult to be the ‘rational’ investor in an irrational environment. You need to take your view from a time, diversification and comfort perspective. To enhance your chance to succeed, you need to be ok when markets are tumbling and stick with your plan. You must maintain discipline, consistency and belief that our global economy will, over time, return performance consistent with the risk you are taking. Lastly, you might need to cuddle up in a blanket full of uncertainty and ignore the dread and “what if’s” that pound your psyche. The only certainty that exists is that the headlines and stories will keep coming. We call it the false perception of safety, one might perceive that the market volatility might entice risks, where the opposite is very often the case. Let’s begin with what we know. We know history. Historically proven, some of the biggest fortune where made in times of economical downturn.

Reach out to one of our Financial Advisors to better understand how we operate, what safety measures we take in our trading activities and ultimately how it could be financially rewarding, especially in those times of uncertainty.