A deadly global pandemic is a self-evidently world-changing event. But world-changing how? While the coronavirus nightmare is nowhere near resolution, we are awash in predictions about what will come next, how our professional and business lives will be permanently altered, and how they will look a decade from now or beyond.

Given all the uncertainty, it is ironic to see so many predictions being thrown around about the post-pandemic future.

These uncertain times call for positive thinking! Indeed, there are plenty of downsides to COVID-19 and social distancing. But nothing like this has happened in a hundred years. And a lot has changed since then. Today, we have a rare opportunity to make a difference with the things we make.

In terms of time to learn/build desirable skills, it’s important that we realize and align with the changes that are affecting every aspect of our lives, how we work, how we operate and surely how we communicate. One such change is the new dimension of social stratification that has emerged between those who can practice social distancing and those who can’t. Predominantly, the future unfolding will be more like this new present.

For product builders and designers, it’s fun to imagine big social changes and their impact on the things we make, what some might have perceived to be irrational, the irrational of yesterday might be the new rational of tomorrow.

A lot of big initiatives, like government programs, are likely required to mitigate the risks of social distancing to society. But there are also ways that individual companies can design and market products for a positive impact.

Alternative ways where it’s harder for people to distance themselves, such as retail, restaurant, deliveries, healthcare will witness more touch-less interaction, more e-learning. Gyms are even setting new guidelines and distanced work stations, webinars are the next way of running seminars. The integration of new technologies and AI into our lives will be forced to advance at a faster pace.

The whole point in forming a socially distanced class of people is to create a “literally” healthier society. But many of us live a world apart from those suffering harm. For anyone who cares about making/selling products with a positive social impact, social distancing is a phenomenon to be understood.

But social distancing is working, and the market is telling us that the economy could bounce back soon as we successfully flatten the curve.

The final possibility is that the market is simply misinformed. Investors spent most of February underreacting to the virus, seeming to discount the possibility of a pandemic right up until February 20 when the market suddenly started sliding.

We are monitoring truly unprecedented times. The backdrop of a global pandemic along with a breakdown of OPEC, has led investors fleeing away from international capital market.

In just two short weeks, the S&P 500 dropped 23% and crude oil prices fell 52%. The freefall in equity markets triggered circuit breakers multiple times.

Oil glut fears are back with a bang after Saudi Arabia and Russia declared an oil price war. The commodity price fell to levels not seen even at the lows of the 2008-9 financial crisis.

WTI oil was down $4 or nearly 20% since opening in Asia on Monday, as sentiment sours again on rising fears on physical storage being nearly full and coronavirus crisis made the strongest negative impact to global demand that hasn’t been seen even during recessions and wars.

The WTI oil price recovered after drop below zero level for the first time in history, but recovery showed signs of stall and reversal pattern is now forming on daily chart.

We may not see the negative prices again but the weakness is likely to persist and stronger recovery might be delayed for some time. Today’s bearish acceleration hit nearly 50% retracement of last week’s recovery and is on track to generate strong bearish signal on strong daily close in red and completion of reversal signal.

Key supports at $10.99 and psychological $10 level are coming in near-term focus, with retest of contract’s record low at not ruled out. Technical studies remain bearish on all timeframes and support the weakness.

The FAANG stocks have totally dominated the US stock markets for some time now. FAANG is an acronym referring to the stocks of the five most popular and best-performing American technology companies: Facebook, Amazon, Apple, Netflix and Alphabet (Google).

In addition to being widely known among consumers, the FAANG stocks are among the largest companies in the world, with a combined market capitalization of over $4.1 trillion.

Some have raised concerns that the FAANG stocks may be in the midst of a bubble, whereas others argue that their growth is justified by the stellar financial and operational performance they have shown in recent years.

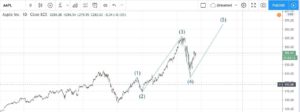

Apple has led the FAANG group by far, with a market cap of $1.2 trillion and a text book wave pattern.

With market picking up from the lows of $140 in 2019, it peaked $325 in 2020 exactly a year from the lows. The drop from $325 was the textbook 4 wave.

According to the theory, wave 4 cannot breach wave 1. What was also interesting, the market was also coincided with the fib extension of 0.61% and reversed sharply in wave 5.

Wave 3 also coincides and calls for a top with the S&P topping and calling for a major reversal.

Wave 5 is in progress and should take price over $350 in the near future.

There are no more “read between the lines”, for those who understand this change and can take advantage of this change to reposition themselves – and the impact it will have on your operating model – will be leading at the forefront of their industry, at such AIX has set in motion a remote process for investors that will cater for those in need of isolation, without affecting their lifestyle and financial status.

After all, if this pandemic has taught us anything, it’s that the future is always more unpredictable than it seems.

Please feel free to reach out to one of our Financial Advisors for more insights into how we can help you in your financial planning.